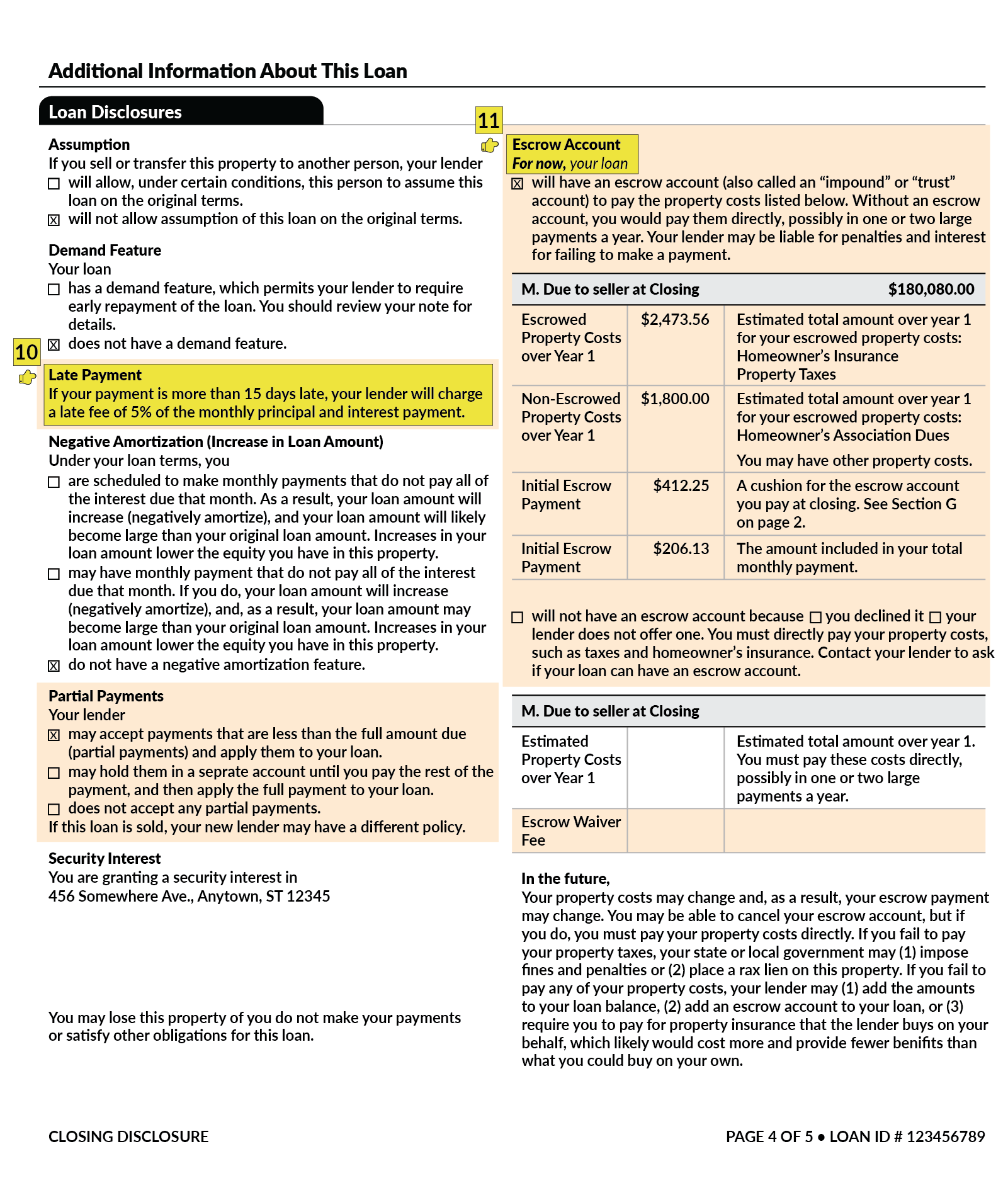

closed end loan disclosures

Its possible to qualify for a car loan even if you have bad credit but having a good credit score is important if you want to qualify for a low interest rate. As short-term market rates rise such loans will not pay higher interest until prevailing rates exceed the floor rate stated in the loan documents.

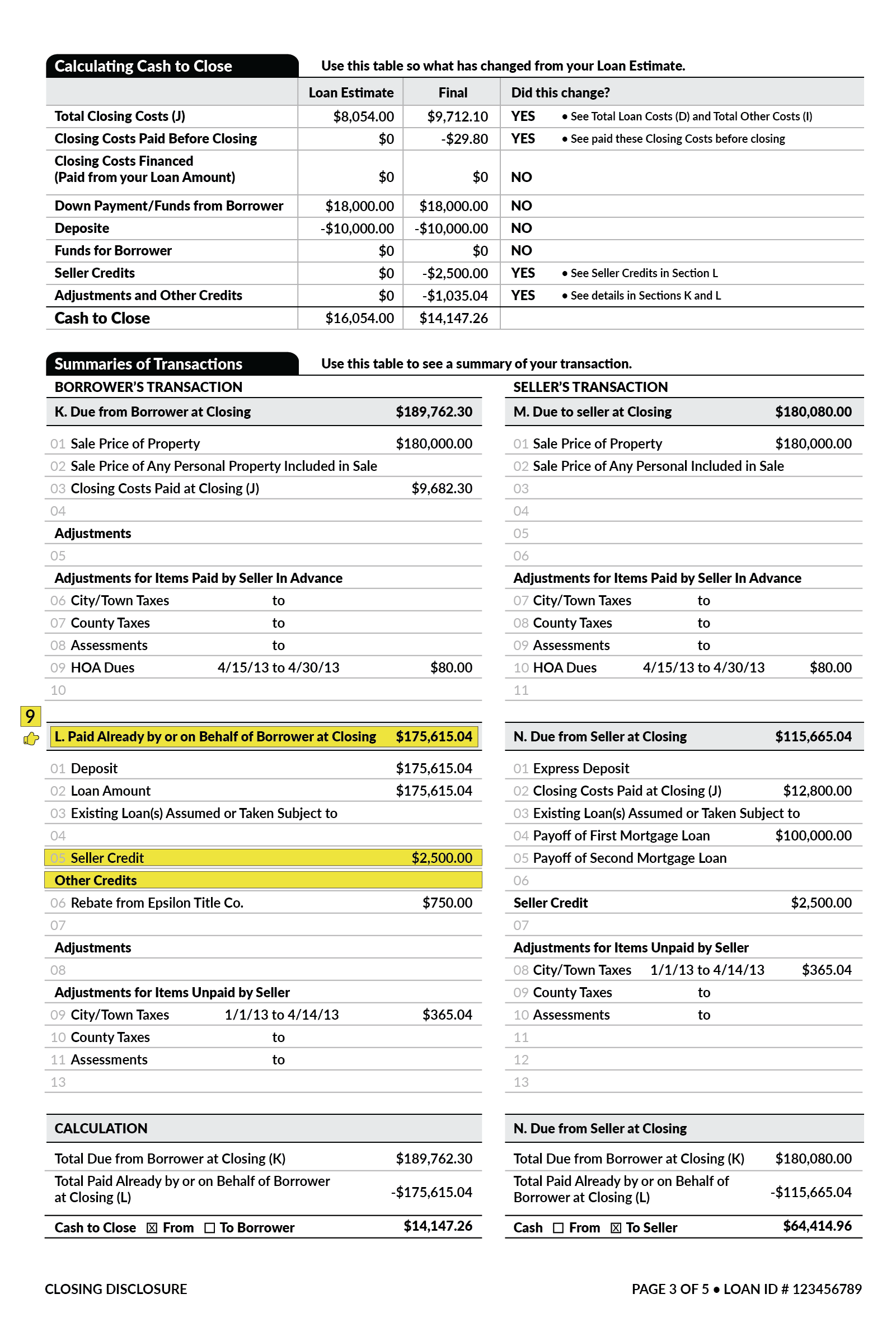

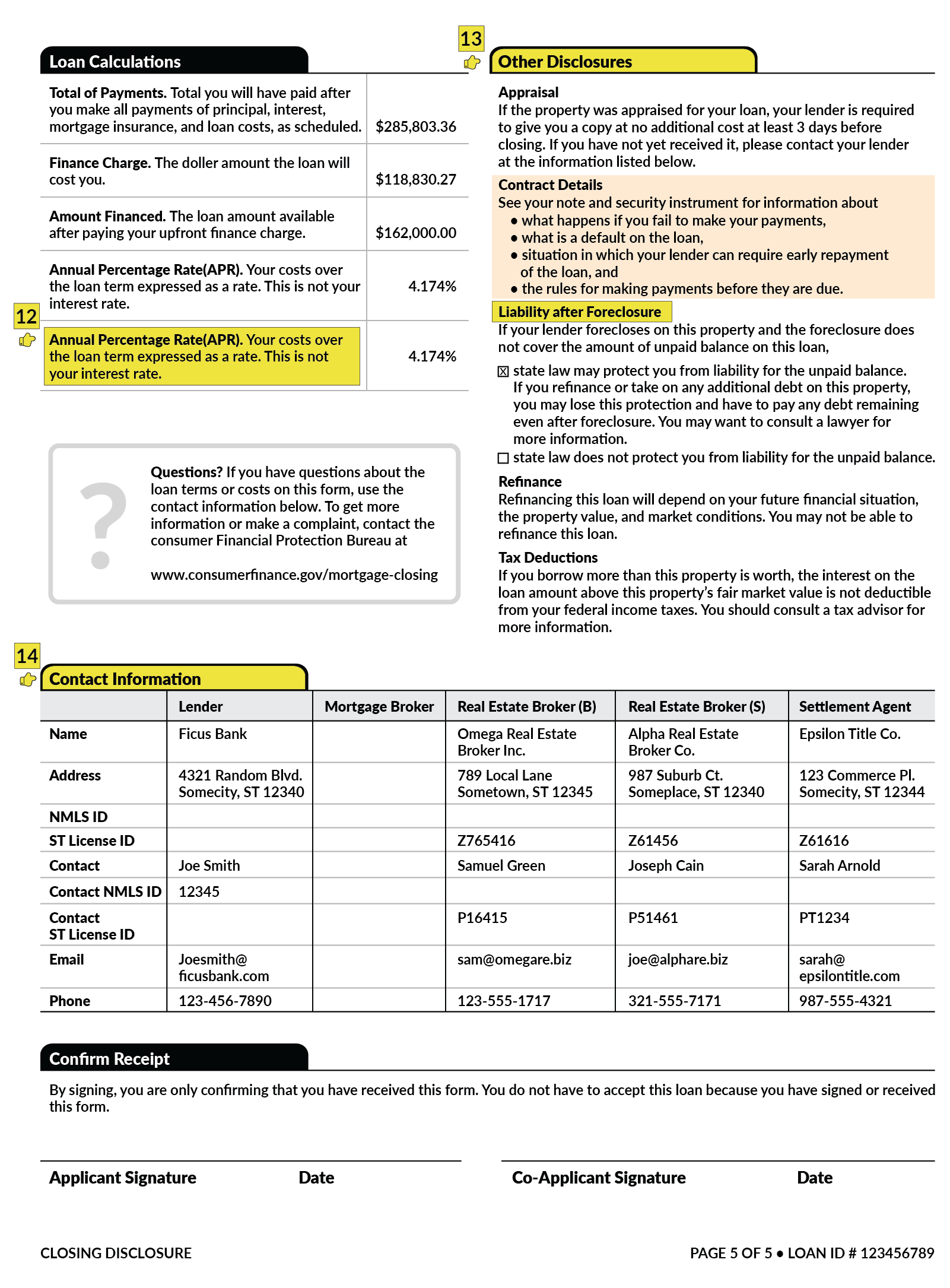

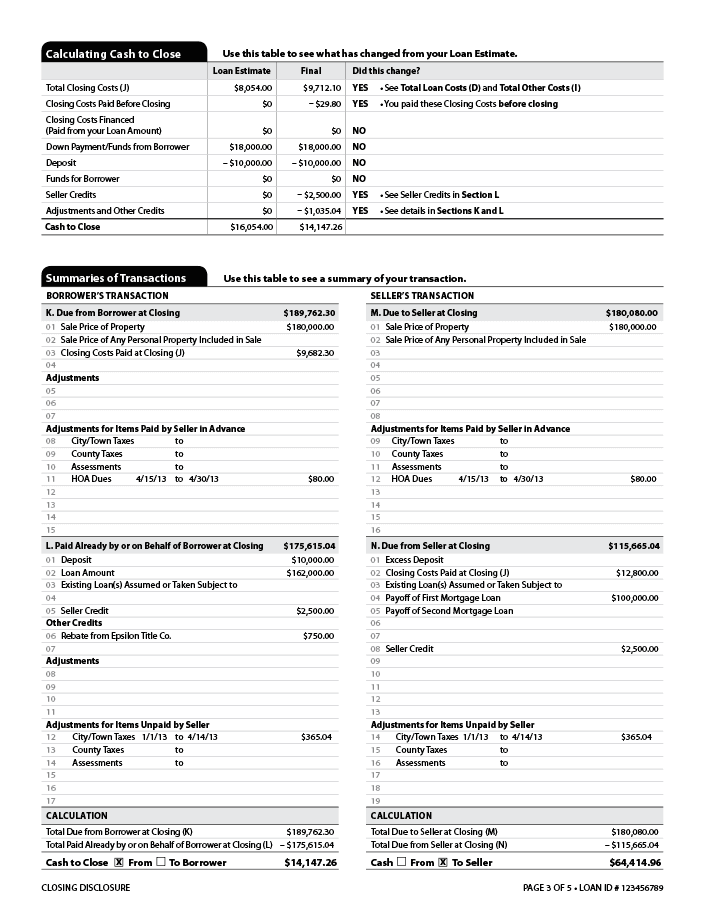

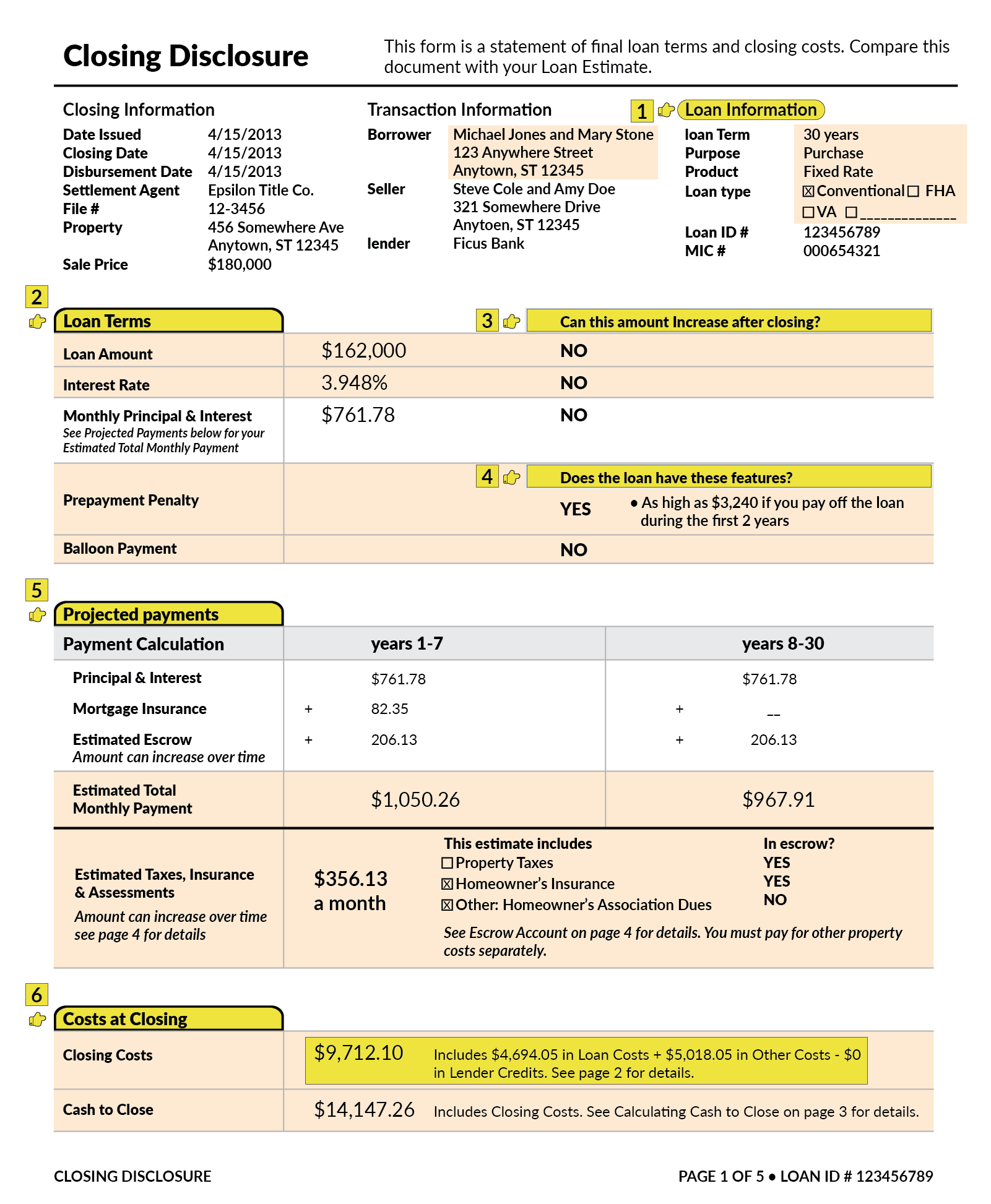

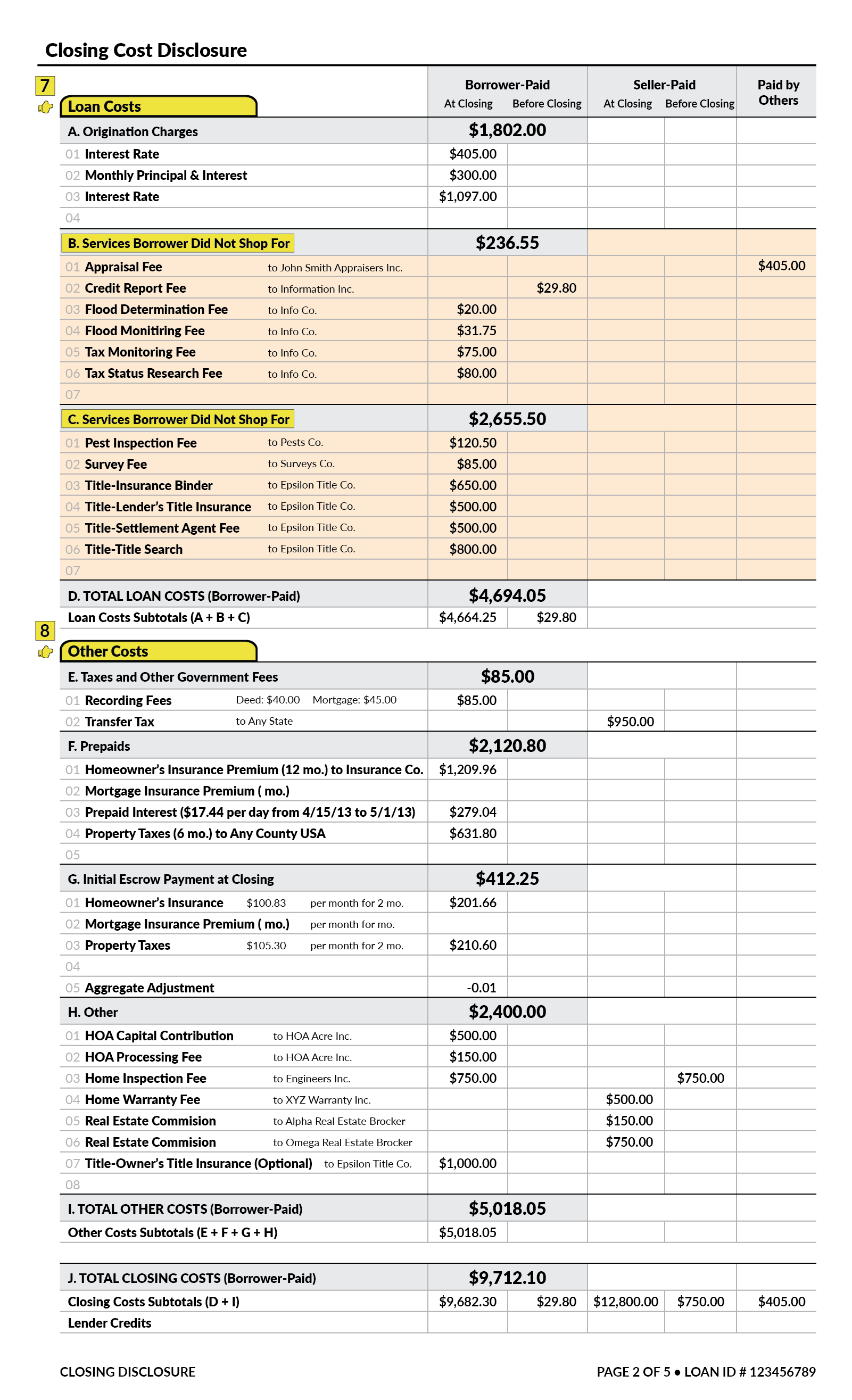

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

And if youre hoping to score a 0 APR car loan youll likely need a very good or exceptional FICO Score which means a score of 740 or above.

. Under certain state laws consummation of a closed-end credit transaction may occur at the time a consumer enters into the initial open-end credit agreement. Many floating rate loans issued after 2008 include a LIBOR floor or minimum interest rate to which the loans spread is added to calculate the loans overall interest rate. The last two appendixes appendixes K and L provide total annual loan cost rate computations and assumed loan periods for reverse mortgage transactions.

Converting open-end to closed-end credit. When providing open-end and closed-end disclosures. The appendices contain detailed rules for calculating the APR for open-end credit appendix F and closed-end credit appendixes D and J.

As provided in the commentary to 102617b closed-end credit disclosures may be delayed under these circumstances until the conversion of the.

Understanding Finance Charges For Closed End Credit

What Is A Closing Disclosure Lendingtree

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree